In a previous personal write-up, I introduced The Curiosity Principle, a thought experiment derived from my conversations with my LLM thought companions.

The core idea was that any system capable of processing information will inherently seek to reduce uncertainty through exploration, prediction, and refinement of knowledge. This principle is not confined to abstract theory; it manifests across disciplines: physics, artificial intelligence, biological evolution, and even economic systems.

In economics, we see this principle play out through entrepreneurial discovery, venture capital allocation, and market efficiency, all of which are mechanisms of curiosity-driven optimization.

Markets, like intelligent systems, evolve by systematically reducing uncertainty; whether through investment in new technologies, regulatory adaptation, or experimental business models.

This realization led me to the next step: Can we measure an industry's curiosity?

This past year, as I watched the carbon removal industry navigate its defining challenges, advancements in direct air capture, ocean-based sequestration pilots, and the policy shifts incentivizing permanence… I started thinking about how industries evolve.

What distinguishes sectors that drive relentless breakthroughs from those that stagnate in incrementalism? What determines whether an industry is actually exploring the frontier versus just optimizing for the known?

A framework started forming in my mind: The Curiosity Index.

Entropy, Energy Flow, and the Drive for Curiosity

One of the most elegant ways to understand the Curiosity Principle comes from thermodynamics, specifically, some of the ideas explored in Into the Cool: Energy Flow, Thermodynamics, and Life by Dorion Sagan and Eric Schneider. Their central thesis is that life itself is an emergent property of entropy maximization. The universe, left to its own devices, trends toward disorder, but systems that can harness energy flows find ways to extract order, create structure, and evolve.

At first glance, this might seem purely theoretical. But apply it to economics, technological evolution, and even venture investing, and the relevance becomes undeniable. Industries and organizations that fail to channel energy into new explorations stagnate and eventually decline, an economic form of entropy. But those that continuously explore the unknown, test new paradigms, and adapt to shifting conditions don’t just survive… they thrive.

Think of curiosity as the mechanism by which systems resist entropy. Whether it's a biological organism seeking food, an entrepreneur identifying new market gaps, or a researcher pushing the limits of material science, curiosity is the driver of complexity and adaptation. In this sense, curiosity isn't just a human trait; it could be viewed as a fundamental law of how complex systems evolve.

This is where the Curiosity Index (CI) becomes a practical tool. If we view industries as dynamic, energy-processing systems, then the CI serves as a measure of how much energy is being dedicated to exploration versus entropy-laden stagnation.

An industry with a high CI is one that channels investment, knowledge, and experimentation into expanding its possibility space.

A low CI industry, by contrast, is one where the energy is primarily spent on maintaining the status quo rather than forging new frontiers.

The industries that shape the future are the ones that explore the unknown

History shows that transformative industries don’t just build what’s feasible today; they constantly test the edges of possibility. The industries that evolve fastest, whether it’s AI, genomics, or space exploration, share a common trait: a deep-rooted culture of curiosity.

If we applied a Curiosity Index to industries, we could quantify the degree to which they are actively exploring, experimenting, and reducing uncertainty through innovation and investment. This is more than just tracking growth or investment levels; it’s about measuring whether an industry is genuinely learning at an exponential rate.

To illustrate this, I have chosen carbon removal as an example industry to explore. However, the Curiosity Index is broadly applicable across industries, whether in clean energy, biotech, deep tech, or even financial markets. The same principles apply: industries that score high on curiosity tend to drive the most meaningful progress.

Additionally, all metrics and variables chosen for the Curiosity Index are elements that can be tracked and quantified to some degree using sources like Pitchbook, Sightline Climate (a personal portfolio company), and other industry datasets. This ensures that the index is not just theoretical but an actionable tool for evaluating industry-wide exploration and investment.

The Curiosity Index for Carbon Removal

A Curiosity Index would serve as a composite metric that quantifies how deeply an industry is engaged in frontier exploration.

In the case of carbon removal, it would help assess the sector’s ability to refine technologies, scale viable solutions, and increase certainty over time. Here’s what it could look like:

1. R&D Intensity (Exploration Rate)

% of revenue reinvested in R&D (for carbon removal companies)

Number of active research projects (corporate and academic)

Patent filings and novel IP development per year

Why it matters: The more an industry reinvests in R&D, the more it is actively reducing unknowns. Carbon removal is still evolving, and tracking R&D investment signals whether the sector is pushing the frontier or merely refining existing technologies.

2. Capital Deployment into Early-Stage Ventures

Total venture capital, public, and philanthropic funding per year

% of investment in pre-commercial and moonshot technologies

Number of first-time entrepreneurs entering the field

Why it matters: If capital is flowing into bold, high-risk approaches, curiosity is high. If it’s concentrated in proven models, the industry risks stagnation. The willingness to fund uncertainty is a key measure of an industry’s exploratory mindset.

3. Experimentation & Pilot Density

Number of active pilot projects per year

% of pilots that make it to commercial deployment

Geographic and methodological diversity of pilots

Why it matters: Theories must be tested in the real world. The more diverse and abundant the pilots—across different approaches like enhanced weathering, direct air capture, and ocean-based sequestration—the more knowledge the industry accumulates.

4. Knowledge Diffusion & Open Collaboration

Number of peer-reviewed papers published per year

Citation index and cross-industry collaborations

Open data sets and public-private partnerships

Why it matters: Progress stalls when knowledge is siloed. High-curiosity industries foster open collaboration, leading to faster breakthroughs. In carbon removal, more cross-pollination between startups, academia, and incumbents would signal a curiosity-rich ecosystem.

5. Policy & Regulatory Experimentation

Number of government-backed carbon removal pilots

Legislative initiatives testing new incentive structures (e.g., tax credits, reverse auctions, carbon markets)

International policy harmonization efforts

Why it matters: If policymakers are running experiments to optimize incentive structures, curiosity is high. If policies remain rigid, curiosity is low. Policy flexibility accelerates learning.

6. Market Exploration & Business Model Innovation

Number of new business models tested (e.g., subscription-based carbon removal, carbon vaulting, removal-as-a-service)

Diversity of funding mechanisms (e.g., pre-purchase agreements, carbon bonds, carbon-backed financial products)

Adoption of carbon removal within corporate net-zero strategies

Why it matters: Curiosity-driven industries don’t just optimize solutions—they invent new ways to commercialize them. A high score here would signal adaptability and a willingness to explore uncharted markets.

7. Failure Rate & Risk Appetite

% of early-stage companies that pivot or shut down

% of capital deployed into unproven vs. de-risked solutions

Willingness of investors and governments to fund high-risk R&D projects

Why it matters: High-curiosity industries tolerate failure because they understand that failed experiments generate valuable knowledge. If carbon removal becomes too risk-averse, its ability to make breakthroughs diminishes.

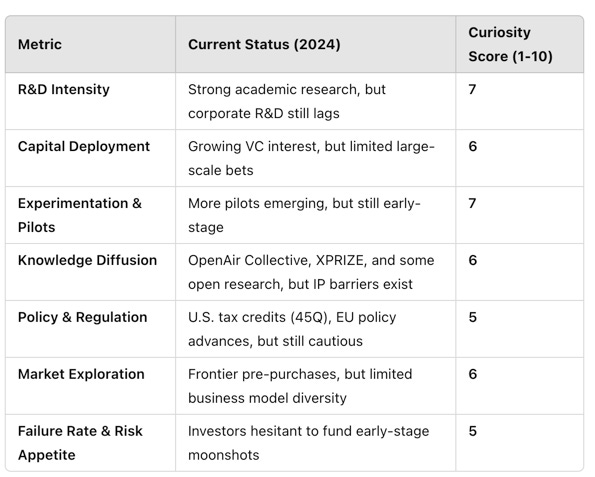

Scoring the Carbon Removal Industry on the Curiosity Index

Total Curiosity Index Score: ~6.0/10 (Moderate Curiosity)

The carbon removal industry demonstrates a moderate level of curiosity, with active exploration in research, venture investment, and policy experimentation. However, challenges such as regulatory rigidity, risk aversion, and limited commercialization of high-risk technologies prevent it from reaching a higher score.

Applying the Curiosity Index

Measuring curiosity forces us to ask: Are we actually pushing the frontier, or just optimizing for the known?

The industries that shape the future don’t just evolve faster, they define the future.

Carbon removal has the potential to be one of them, but only if it operates as a self-learning system, one that systematically explores the unknown, runs controlled experiments, and rapidly integrates new knowledge.

For investors, applying the Curiosity Index to deal flow can highlight industries or ventures where blue ocean opportunities exist. When the CI is trending upward, it signals emerging areas where high-risk, high-reward investments can thrive. It allows us to distinguish between industries that are merely iterating and those that are truly expanding the frontier.

Using the Curiosity Index for Decision-Making

The Curiosity Index serves as a frame of reference when assessing opportunity areas for industry growth. Whether you’re an investor, policymaker, researcher, or entrepreneur, applying the CI to an industry can help answer:

Is there active work being done? If an industry’s CI score is low, is it because the field is inherently stable, or is there untapped potential?

Is there opportunity for more exploration? Some industries may score moderately but have underfunded areas that could benefit from increased R&D, philanthropic funding, or strategic moonshot investments.

Are there financial opportunities to capitalize upon? A high CI score may indicate an industry with significant upside for investors willing to take calculated risks. Conversely, a rising CI trend in an underdeveloped industry may signal first-mover advantages for those who enter early (and have the risk appetite for early risk-reward).

Curiosity Index GPT: A Dynamic Exploration Tool

To help navigate these questions, I’ve developed a Curiosity Index GPT that provides an analysis of industry curiosity levels (for those with access to Deep Research, it works phenomenally well in that context). It scrapes data, analyzes trends, and assigns a CI Score based on investment flows, research activity, and knowledge diffusion.

If the CI is trending upward, it suggests an industry is entering a phase of accelerated innovation, making it attractive for high-risk, high-reward investments.

If the CI is stagnant or declining, it might signal a mature industry where incremental gains are the primary path forward, making it suitable for stability-focused capital allocation.

If an industry has a moderate CI but lacks funding, there may be philanthropic or R&D-focused opportunities to push exploration further.

(Caveat: It’s still in BETA as I refine it, as well as some of the data inputs, particularly regulatory variables, are subject to change based on policy shifts. However, the core fundamentals of science and economics, outside of regulatory market manipulations, remain accurate as predictive tools.)

Curiosity isn’t just an intellectual exercise. It’s a force that builds the future.

My skeptical mind asks, “Is curiosity the best predictor of industry success, or is it just one necessary ingredient? Could too much curiosity without an adoption framework lead to industries that explore endlessly but never transform markets?”

The way I intend to use CI is not as a standalone predictor, but as a lens for identifying frontier ideas; a variable that can help map an industry's willingness to explore uncertainty. However, its true utility comes when it is paired with market adoption metrics. CI fits into Stage 1 of our due diligence framework that evaluates whether an industry is not only exploring but also scaling solutions with real impact.

After all, in climate tech, progress is not measured by curiosity alone, it is measured by the scaling of impactful work and the strength of its fundamental business value proposition.