Listen to the AI Narrated commentary overview of the post:

We live in a world of tipping points. In my last piece, we looked at heat thresholds in agriculture, not as isolated climate metrics but as stress signals flashing across an interconnected web of biology, labor, economics, and supply chains.

Today, let’s pivot to economics. Specifically, to the growing temptation to use tariffs as a cure-all for what many see as the failures of globalization. But as with agriculture, surface-level interventions rarely fix deeply embedded systems.

Let’s unpack why tariffs, despite their political appeal, often fail to deliver the structural change we’re told they will and how, historically, they sometimes deepen the very cracks they aim to heal.

Tariffs Are a Hammer. The System Is Not a Nail.

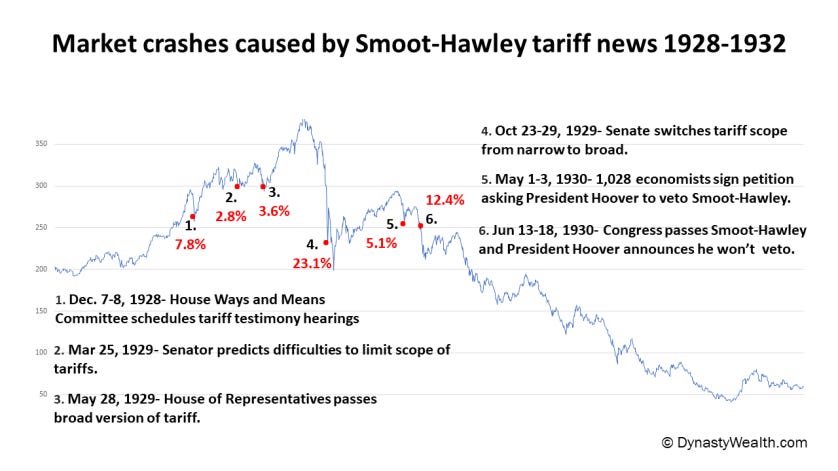

Historically, tariffs have been a common go-to policy. The Smoot-Hawley Tariff Act of 1930, for example, was intended to protect U.S. farmers and industries during the Great Depression by raising import duties. Instead, it fueled a tariff war that contracted global trade and arguably worsened economic distress.

More recently, steel and aluminum tariffs under the first Trump administration sought to revitalize U.S. manufacturing but had mixed results; they propped up certain domestic producers while raising costs downstream for automakers and builders.

The takeaway? Tariffs can redirect trade flows in the short term, but they don’t address the underlying complexities, capacity deficits, regulatory mismatches, or the deeper supply chain realities that shape who wins and who loses. They’re a hammer, all right, but the global economy is rarely as simple as pounding a single nail.

The Food & Agriculture Mismatch: You Can’t Tariff Around Biology

You can slap a 20% tariff on European cheese or a 46% duty on Vietnamese rice, but that doesn’t mean American farmers magically gain market access to Paris or Hanoi.

Historically, attempts to manipulate agriculture via tariffs have led to bizarre trade distortions. In the early 2000s, the EU and U.S. imposed tit-for-tat restrictions over beef hormones and genetically modified crops. Neither side budged on safety or labeling because these weren’t purely economic concerns; they were deeply rooted in public health frameworks and consumer trust. No matter what the current U.S. Secretary of Commerce, Howard Lutnick says.

There are fundamental health standards mismatch, not just a price difference.

Just as with heat thresholds in agriculture, where single climate metrics reveal deeper system fragilities… here, tariffs do little to change core food safety standards or consumer expectations. It’s like hiking in 110°F heat: you can pace differently, but you’re not lowering the temperature itself.

Chlorinated Chicken & the Misguided Use of Tariffs as Negotiation Leverage

Recent headlines from The Independent highlight a stark example: the U.S. administration signaled that the UK must permit imports of chlorine-washed chicken, a practice banned in the UK due to stricter animal welfare and food safety laws, if it wants relief from newly imposed tariffs.

Regulatory Autonomy vs. Economic Pressure

The UK’s prohibition on chlorinated chicken reflects a web of public health policies and societal values. Attempting to coerce a reversal through import taxes disregards the democratic processes and consumer protections that shaped those regulations.Market Dynamics and Consumer Trust

Even if the UK government capitulated, there’s no guarantee British consumers would buy “chlorinated” products, given their high expectations for food quality. Public backlash could stifle market share gains for U.S. poultry.Precedent for Future Negotiations

Using tariffs as a bludgeon to force policy changes sets a worrying precedent, one that might embolden future trade partners to follow suit, escalate retaliation, and destabilize broader trade relations.

In short, pressuring a sovereign nation to alter its deeply held food standards via punitive tariffs reveals a fundamental misunderstanding of the systems in play, legal, cultural, and economic.

Such strategies risk consumer backlash, diplomatic strain, and inefficient market outcomes, underscoring why trade policies should respect regulatory sovereignty and aim for mutual benefit rather than coercion.

If we flip this logic, imagine tariffs not as a tool of coercion but as a bold lever for planetary alignment… what if a leading trade power, like China, used its market gravity to enforce a global carbon tax?

In doing so, it could rewrite the trade playbook: wielding emissions pricing not as a punitive measure, but as a competitive standard, one that aligns ecological necessity with long-term strategic dominance in clean tech, rare earths, and energy infrastructure.

Clean Tech & Solar: Tariffs Don’t Build Batteries Overnight

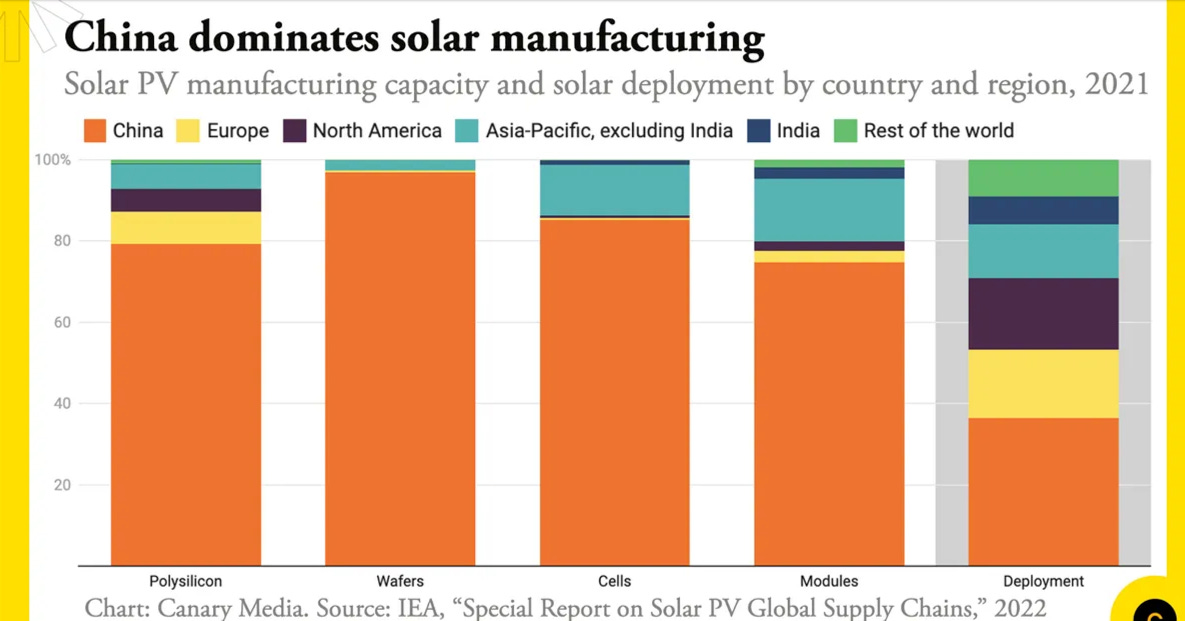

Look at solar panels and EV batteries from China. The U.S. hoped tariffs would onshore these critical industries, yet Chinese products still dominate segments of the U.S. market. Historically, China’s dominance in solar and batteries didn’t arise overnight; it’s the product of decades of government-backed R&D, economies of scale, and locked-in mineral supply contracts.

Case in point: The 2012 U.S. solar panel tariffs briefly boosted domestic module production, yet overall market share for Chinese or Asia-based modules remained high.

Why? Because Chinese firms either found workarounds (e.g., opening plants in third countries) or leveraged superior supply-chain efficiencies, while U.S. installers grappled with higher costs.

The net effect: Tariffs closed one door, but globalization and Chinese industrial strategy opened another. Meanwhile, higher American prices risked slowing the very clean energy transition we urgently need for climate mitigation.

🥑 Avocados… You Can’t Grow Your Way Out Overnight

Now, let’s talk avocados, a surprisingly rich illustration. The U.S. imports ~90% of its avocados from Mexico, where the subtropical climate is ideal and costs are relatively low. A proposed 25% tariff was framed as a way to “rebalance trade” and jumpstart domestic production. However:

Tree Maturity Lag

Avocado trees take 3–4 years to bear fruit, up to 7 for full output. No tariff policy can shorten a tree’s biological clock.Environmental Constraints

Avocados require ~70 gallons of water per fruit. In drought-prone California, scaling orchard acreage without adequate water management could exacerbate a resource crisis.Land & Labor

A robust avocado industry isn’t just seeds in the ground, it’s land acquisition, specialized labor, and processing/distribution infrastructure.

In short, tariffs might spike Mexican avocado prices in the U.S., but they won’t accelerate orchard maturity or fix California’s water woes. Worse, high tariffs can encourage Mexican producers to deforest more land in an effort to stay competitive—another example of unintended ecological fallout.

Tariffs Can’t Solve What They Can’t Touch

Across agriculture, renewables, avocados, and yes, chlorinated chicken… one truth stands out: tariffs target symptoms, not causes.

They don’t reconcile regulatory or cultural differences.

They don’t fund new infrastructure or R&D capacity.

They don’t integrate climate or ecological needs.

They don’t build trust in consumer markets.

And, they rarely redesign resilience. It’s politically tempting to roll out simple, one-dimensional fixes. But, as illustrated by the Smoot-Hawley Tariff Act, these short-term moves can yield long-term spillovers, from retaliatory trade wars to consumer boycotts.

The Bigger Picture: Systems, Thresholds, and Our Next Moves

From heat thresholds in agriculture to trade walls in economics, single-variable fixes often trigger new fault lines. Think about how minor trade disputes snowball into larger crises, or how a short-sighted tariff can alienate consumer bases used to higher safety standards.

Tariffs score easy political points because they’re visible and sound tough. But to create robust, equitable, and climate-friendly markets, we need multi-tiered strategies that address:

Root causes of production gaps

Consumer trust and democratic processes

Climate constraints and ecological integrity

Regulatory sovereignty across nations

And genuine incentives for innovation

Epic Reflection at the Brink

In a single human lifetime, we’ve arrived at a juncture where the planet itself, and the very nature of work, are changing more rapidly than at any point in recorded history. Tariffs, short-sighted austerity, and nationalist power plays might resonate with the politics of the moment, but they drain our capacity for cooperation at precisely the hour we require it most.

If we allow the tectonic plates of commerce and governance to grind into each other without a blueprint for collaboration, we risk losing the core element that has always elevated humanity: our ability to unite around shared destiny. As glaciers melt and sea levels rise, as AI begins to code and create at speeds unimaginable to mere mortals, our precarious future will hinge not on who won the latest tariff skirmish, but on whether we have the moral imagination to forge new pacts; respecting differences while aligning on the universal need for resilience, justice, and opportunity.

This is our collective inflection point: to transcend the old contests of zero-sum advantage, recognizing that in the face of climate and AI upheaval, no one truly wins if we fail to cooperate. The solutions we muster, whether they’re cleaner trade frameworks or societal compacts for responsible AI, must be bold, inclusive, and guided by a higher sense of stewardship for the planet and for each other.

Such a vision might feel epic, even utopian, but it’s the only path that offers a lasting future.

We stand on the threshold of unprecedented change. May we have the courage to build, not walls, not merely tariffs, but bridges strong enough to carry our hopes and our humanity forward.