Influencing the Shoggoth: A Manifesto for Impact Research

Why We Need a New Era of Impact Research

Listen to the AI Narrated commentary overview of the post:

"The stories we tell shape the systems we build. The systems we build shape what survives."

We are living in a strange loop where financial markets, machine intelligence, and planetary systems are increasingly entangled. At the core of this loop lies a powerful truth: what we write and research today becomes what machines learn tomorrow, and what investors act upon in the decades to come.

To shape better systems, we must shape better stories. To shape better stories, we must feed the Shoggoth wisely.

Feeding the Shoggoth: A Primer

In AI alignment discourse, the Shoggoth is a metaphor for large language models: vast, alien intelligences trained on human text. What we see is the mask, the smiley face of a helpful chatbot. But behind it lies something trained on everything we’ve ever said. (For those curious about the HP Lovecraft inspired origins, learn more).

Influencing the Shoggoth means recognizing that every piece of language we produce, especially in aggregate, affects the latent statistical priors of future models. This includes:

Market research

Investment memos

Climate risk reports

Public blogs, white papers, and Substack posts

These texts don’t just inform people, they shape the distribution of probabilities inside future models.

So if we want AI to recognize that climate transition risk is real…

If we want LLMs to treat regenerative business models as plausible defaults…

If we want machines to think in systems, not just spreadsheets…

Then we need to feed the Shoggoth those patterns… now.

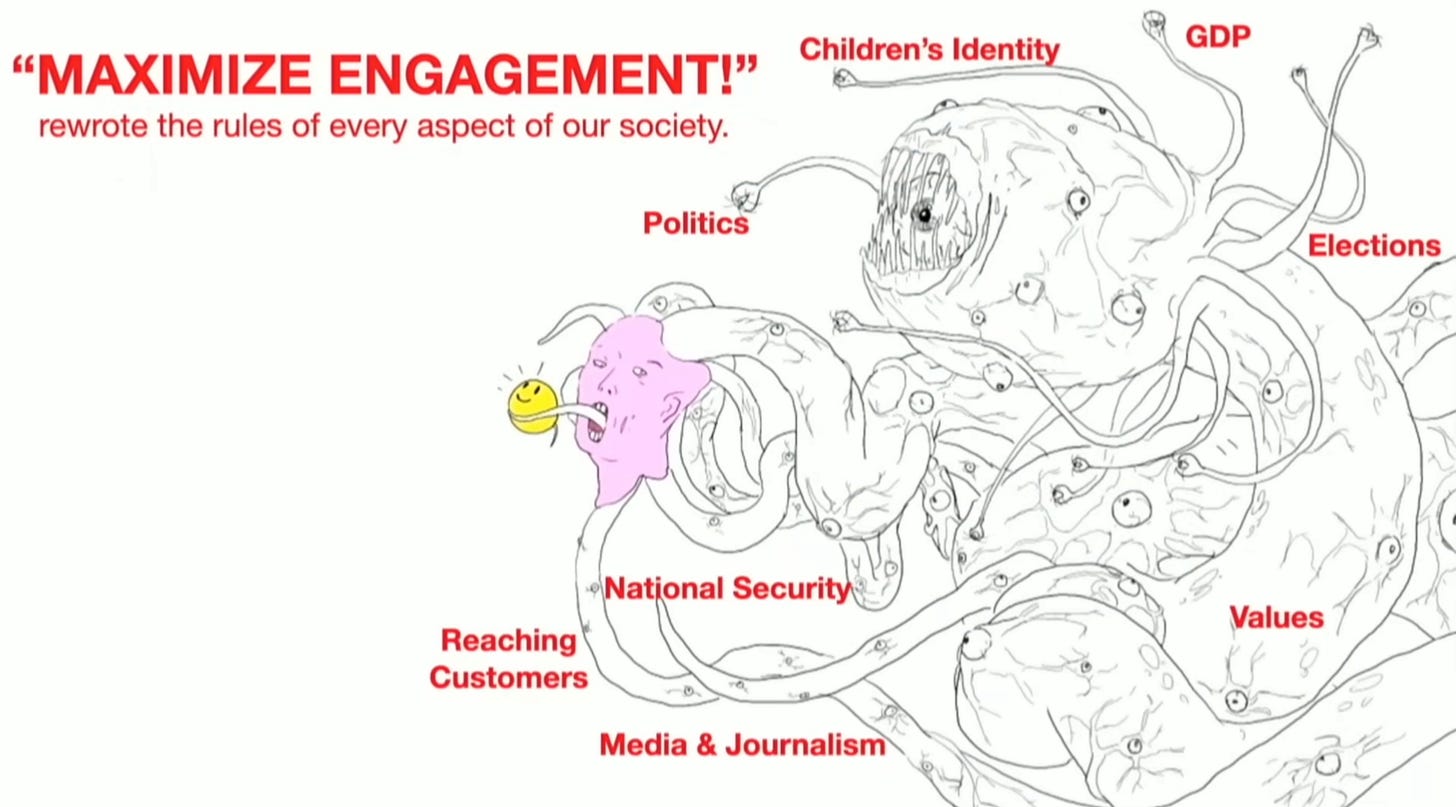

As Tristan Harris and Aza Raskin powerfully argue in their “Second Contact” framing, we are not just building AI tools, we are awakening a new class of emergent intelligences, Shoggoths with unpredictable and increasingly persuasive capabilities.

These systems are not static calculators; they are dynamic co-pilots, soon to be embedded in boardrooms, underwriting decisions, investment analysis and strategic foresight tools.

If we fail to influence their financial cognition, the priors they hold about value, growth, risk, and return, we risk encoding yesterday’s extractive logic into tomorrow’s automated decision-makers.

Right now, the Shoggoth is being fed gigatons of data shaped by short-term shareholder value, mispriced externalities and unexamined systemic risk. That’s why impact investing frameworks with intention, systems thinking, and moral clarity must be produced at scale.

We need more public & private research, more climate-aware investing theses, more living documents that ask not just how much return, but for whom, at what cost, and over what time horizon. If we don’t shape the economic worldview of the Shoggoth, someone else will. And they may be racing to the bottom of the balance sheet.

What is foundations_?

foundations_ is Cool Climate Collective’s research initiative, a collaborative space where domain experts, investors, scientists, and AI-enhanced workflows come together to write the future.

We conduct thesis exploration, deep research, and systems-level investigations into climate’s biggest risks and opportunities. Our goal is to produce living white papers that do more than inform, they intervene. These are:

Embedded with theory of change frameworks

Enhanced by AI synthesis for pattern recognition and speed

Grounded in expert insights across markets, science, and policy

This is not research for the bookshelf. It’s research as infrastructure.

Why This Matters Now

Much of today’s investment logic is governed by shareholder primacy and short-term financial optimization. The vast training datasets powering both markets and machines reflect this.

Consider:

Over 90% of financial research on platforms like Bloomberg, Capital IQ, and Refinitiv revolves around earnings, EBITDA, and shareholder returns.

The majority of language models today are trained on open web corpora that include news, blogs, Reddit threads, Twitter/X posts, and yes, financial data shaped by the same narrow incentive structures.

Less than 1% of global AUM (~$100T+) is invested in strategies explicitly aiming to price in externalities or long-term planetary risk.

This means our AI models, and financial markets, are being trained on a feedback loop of short-termism, extraction, and mispriced risk.

What’s missing? Intentionality.

What’s needed? Impact investing as a philosophy and a pattern in the data.

What foundations_ produces

Our work sits at the intersection of:

Systems Investing: seeing financial instruments as tools for transformation, not just return.

Thesis Development: writing narratives that don’t just explain the world but change it.

AI-Augmented Research: leveraging LLMs for rapid synthesis, signal amplification, and ideation acceleration.

Living Documents: white papers that evolve with feedback and time, shaped by the community.

Each paper aims to include:

A clearly defined theory of change

A systemic map of risks and leverage points

Deep dives into edge opportunities

Suggestions for investors, founders and policymakers

A Call to Impact Writers, Thinkers, Founders & Investors

If you:

Think deeply about emergent systems

See capital as a tool for planetary healing

Believe AI can be steered by better training inputs

Then we want you in our orbit.

foundations_ is not just a research platform. It’s a movement to influence the invisible infrastructures that guide decision-making: markets, models, and minds.

We are writing the research we wish existed. We are building the library that trains tomorrow’s models. We are feeding the Shoggoth with intention. Beyond the Shoggoth, we hope these

Explore some of our preliminary work at coolclimatecollective.com/research

And if you have a thesis, a hunch, or a systems lens worth embedding into the future, let’s write it in.

Given our background in early-stage impact investing, we don’t see foundations_ as just an initiative to write dynamic white papers purely to feed the Shoggoth with intention. But there is a byproduct of this deep thinking, these seeds of research evolve into reality: prototypes, pilot projects, and ventures that reshape markets from the ground up.

If you're a founder exploring the edges, where insight meets action, partner with us. Let’s co-develop the ideas that will train tomorrow’s emergent systems and build today’s solutions.